Bridge lending in Colorado offers swift, flexible funding for temporary cash flow needs, leveraging equity in assets like real estate or personal property. Ideal for real estate transactions, business expansion, and unexpected expenses, Colorado lenders provide competitive interest rates and tailored terms. Local bridge lending companies excel due to the state's robust economy and market understanding, offering a safe net for startups and SMEs during economic shifts. The structured application process ensures smooth access to this vital financial safety net, with success stories showcasing its ability to drive growth and economic contributions across Colorado.

In today’s fast-paced business landscape, quick funding solutions are essential for entrepreneurial success. For businesses in Colorado seeking immediate capital, bridge lending offers a strategic alternative to traditional financing. This article delves into the intricacies of bridge lending in Colorado, exploring its mechanisms, benefits, eligibility criteria, and real-world applications. Discover how this innovative approach can empower business owners to secure funding swiftly and effectively.

- Understanding Bridge Lending in Colorado: A Quick Funding Solution

- How Does Bridge Lending Work?

- Benefits of Choosing Colorado-Based Bridge Lending Companies

- Types of Businesses Eligible for Bridge Loans in Colorado

- The Application Process: What to Expect

- Success Stories: Real-Life Examples of Bridge Lending in Action

Understanding Bridge Lending in Colorado: A Quick Funding Solution

Bridge lending in Colorado offers a quick funding solution for individuals and businesses facing temporary cash flow challenges. This type of financing involves borrowing against the equity in an asset, such as real estate or personal property. The loan is designed to provide immediate funds while allowing the borrower to retain ownership of the asset. Repayment typically occurs once a long-term financing option becomes available, making it an attractive choice for those needing swift access to capital.

In Colorado, bridge loans are often utilized in various scenarios, including real estate transactions, business expansion, or unexpected expenses. Lenders in this state offer flexible terms and competitive interest rates, catering to both residential and commercial borrowers. Understanding the mechanics of bridge lending can help individuals and businesses navigate financial hurdles efficiently.

How Does Bridge Lending Work?

Bridge lending in Colorado offers a temporary financial solution for individuals and businesses needing quick access to cash. This type of lending is designed to fill the gap between an immediate funding need and the time it takes to secure a traditional loan or sell an asset. It works by providing a short-term, high-value loan secured against a future asset, often real estate. The lender assesses the value of the asset, determines the loan amount up to a predetermined percentage, and extends the credit.

Once the underlying asset is sold—be it a property or another valuable item—the loan is repaid, including interest. Bridge loans in Colorado are particularly useful for real estate investors who need funds for renovations, purchases, or to cover unexpected expenses while waiting for traditional financing options to materialise. This flexible funding source allows for swift decision-making and execution, catering to the urgent financial needs of borrowers in a competitive market.

Benefits of Choosing Colorado-Based Bridge Lending Companies

Choosing a Colorado-based bridge lending company offers several advantages for individuals and businesses in need of quick funding solutions. One of the key benefits is accessibility; these companies are strategically located in a state known for its robust economy and diverse business landscape, enabling them to provide services to a wide range of clients. This local presence ensures that you have access to fast and efficient funding when traditional banking options fall short.

Additionally, Colorado-based bridge lenders often possess a deep understanding of the local market dynamics, allowing them to offer tailored financial solutions. They are attuned to the unique needs of businesses operating within the state, providing flexible terms and competitive rates. This specialized knowledge translates into better negotiations and more favorable loan conditions, ultimately empowering borrowers to make informed decisions about their financial future.

Types of Businesses Eligible for Bridge Loans in Colorado

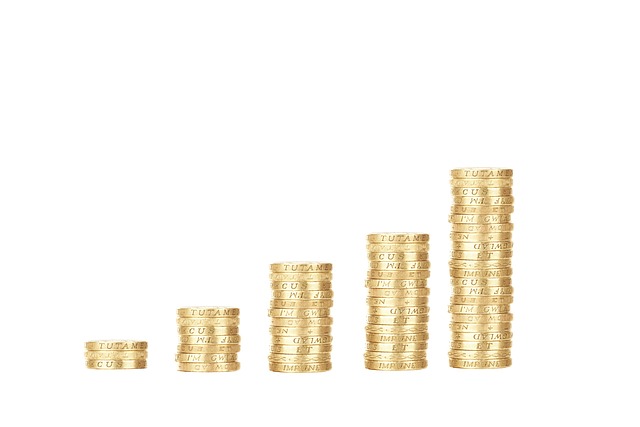

In Colorado, various types of businesses can access bridge loans as a quick funding solution. These loans are particularly beneficial for startups and small to medium-sized enterprises (SMEs) that require immediate financial support to bridge the gap between funding needs and long-term financing options. Eligible businesses typically include those in sectors such as technology, healthcare, agriculture, and renewable energy. Entrepreneurs launching new ventures or expanding existing ones can also avail of these loans to fund equipment purchases, inventory acquisition, or working capital requirements.

Bridge lending Colorado offers a range of advantages for eligible entities. It provides short-term funding with flexible repayment terms, allowing businesses to focus on growth and stability while exploring more permanent financing options simultaneously. This type of lending is especially attractive during unforeseen circumstances like economic downturns or sudden market shifts when traditional loan sources might be less accessible.

The Application Process: What to Expect

When exploring quick funding solutions, understanding the application process is crucial for a seamless experience. For bridge lending Colorado offers an efficient and structured approach. Applicants are typically required to provide detailed financial information, including income statements, tax returns, and asset details. This step ensures lenders have a comprehensive view of your financial health, enabling them to make informed decisions quickly.

The application process often involves multiple document uploads, online forms filling, and possibly even video or phone interviews. Bridge lending platforms streamline these steps by offering user-friendly interfaces. Expect clear instructions at each stage, ensuring you know what’s needed before submitting your application. Keep in mind that while speed is a key advantage, thoroughness in your application is vital to secure the best funding options.

Success Stories: Real-Life Examples of Bridge Lending in Action

In the dynamic world of finance, bridge lending has emerged as a lifeline for businesses and individuals seeking rapid funding solutions. Colorado, with its thriving economy and diverse business landscape, has witnessed numerous success stories where bridge lending played a pivotal role in overcoming financial hurdles. For instance, consider a local startup that was on the cusp of launching an innovative tech product but lacked the necessary capital to cover initial production costs and marketing expenses. Through a strategic bridge loan from a Colorado-based lender, they were able to secure the funding needed, launch their product successfully, and capture a significant market share within months.

Another real-life example involves a small business owner in Denver who needed immediate funds to expand their operations and meet unexpected cash flow challenges. A bridge lending institution in Colorado stepped in with a short-term loan, allowing the owner to cover overhead expenses and invest in additional inventory. With the successful expansion and increased revenue, the business was able to repay the loan swiftly and continue thriving. These success stories highlight how bridge lending in Colorado has enabled businesses to navigate financial storms, seize growth opportunities, and ultimately contribute to a robust local economy.

Bridge lending in Colorado offers a swift and flexible funding solution for businesses in need. By understanding the application process and the benefits these companies provide, entrepreneurs can access much-needed capital quickly. This alternative financing method has proven to be a game-changer for numerous Colorado-based businesses, enabling them to navigate financial challenges and seize growth opportunities. So, if you’re seeking prompt funding, exploring bridge lending could be a strategic move for your venture.