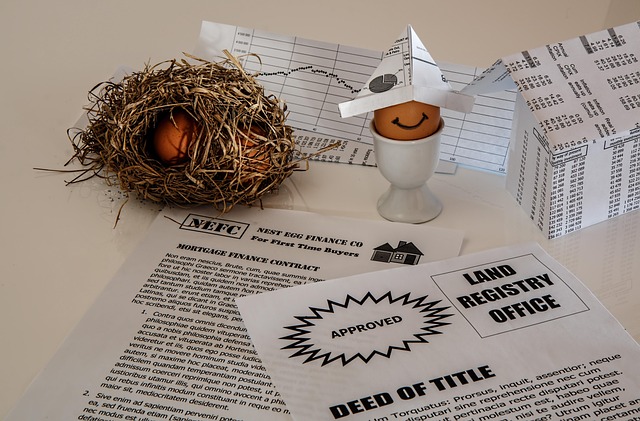

Bridge Lending Colorado provides flexible, short-term financing solutions for individuals and businesses with diverse funding needs. Customizable loan packages include adaptable interest rates, repayment schedules, and fees, enabling borrowers to navigate financial challenges while seizing opportunities like debt payoff, new ventures, or unexpected expenses. This personalized approach ensures peace of mind, acknowledging that every financial journey is unique.

“Bridge Lending Colorado offers a unique approach to financing, providing tailored solutions with customized loan packages. This article delves into the art of unlocking these exclusive opportunities, catering to various needs. We explore ‘Understanding Bridge Lending Colorado’ and its role in creating personalized financing options. By navigating these strategies, individuals can unlock benefits, ensuring financial flexibility and growth. Discover how this innovative concept empowers you to take control of your financial future.”

- Understanding Bridge Lending Colorado: Unlocking Customized Loan Packages

- How to Navigate and Benefit from Personalized Financing Options

Understanding Bridge Lending Colorado: Unlocking Customized Loan Packages

Bridge lending Colorado offers a unique and tailored solution for borrowers seeking customized loan packages. This specialized financial service is designed to meet the diverse needs of individuals and businesses, ensuring access to funds when traditional banking options may fall short. By understanding bridge lending, borrowers can unlock doors to flexible financing that adapts to their specific circumstances.

Whether it’s a short-term gap in funding or a need for rapid capital injection, bridge loans step in as a temporary financial bridge. These loans are particularly beneficial for real estate investors, entrepreneurs, and individuals facing financial challenges. With customizable terms, interest rates, and repayment options, bridge lending Colorado provides a level of adaptability that conventional loans often lack. This customization ensures borrowers receive a package that aligns precisely with their requirements, offering peace of mind and the freedom to navigate unforeseen financial obstacles.

How to Navigate and Benefit from Personalized Financing Options

Navigating personalized financing options, like bridge lending Colorado, requires understanding your unique financial needs and goals. This approach goes beyond conventional loans by tailoring specific terms to match individual circumstances. It’s a strategic move that can offer several advantages. For instance, customized loan packages often feature flexible interest rates, adaptable repayment schedules, and even discounted fees—all designed to align with your ability to repay.

By embracing bridge lending Colorado or similar tailored financing, individuals and businesses alike can gain significant ground in their financial pursuits. Whether it’s accelerating debt payoff, funding a new venture, or securing capital for an unexpected expense, personalized options provide the agility needed to seize opportunities as they arise. Embracing this approach means recognizing that your financial journey is unique, and so should be the tools you use to chart its course.

Bridge lending Colorado offers tailored loan packages that cater to diverse financial needs. By understanding personalized financing options, individuals can access flexible funding solutions optimized for their unique situations. Embracing these customized loans empowers folks to navigate financial challenges and seize opportunities with enhanced security and strategic planning. Leverage the expertise of bridge lenders in Colorado to unlock competitive rates and terms, ensuring a brighter financial future.